Business Insurance in and around Wood Dale

Calling all small business owners of Wood Dale!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a veterinarian, a confectionary, a fabric store, or other.

Calling all small business owners of Wood Dale!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

Your business is unique and faces specific challenges. Whether you are growing a shoe repair shop or a pizza parlor, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Fernando Flores can help with a surety or fidelity bond as well as life insurance for a group if there are 5 or more employees.

Let's discuss business! Call Fernando Flores today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

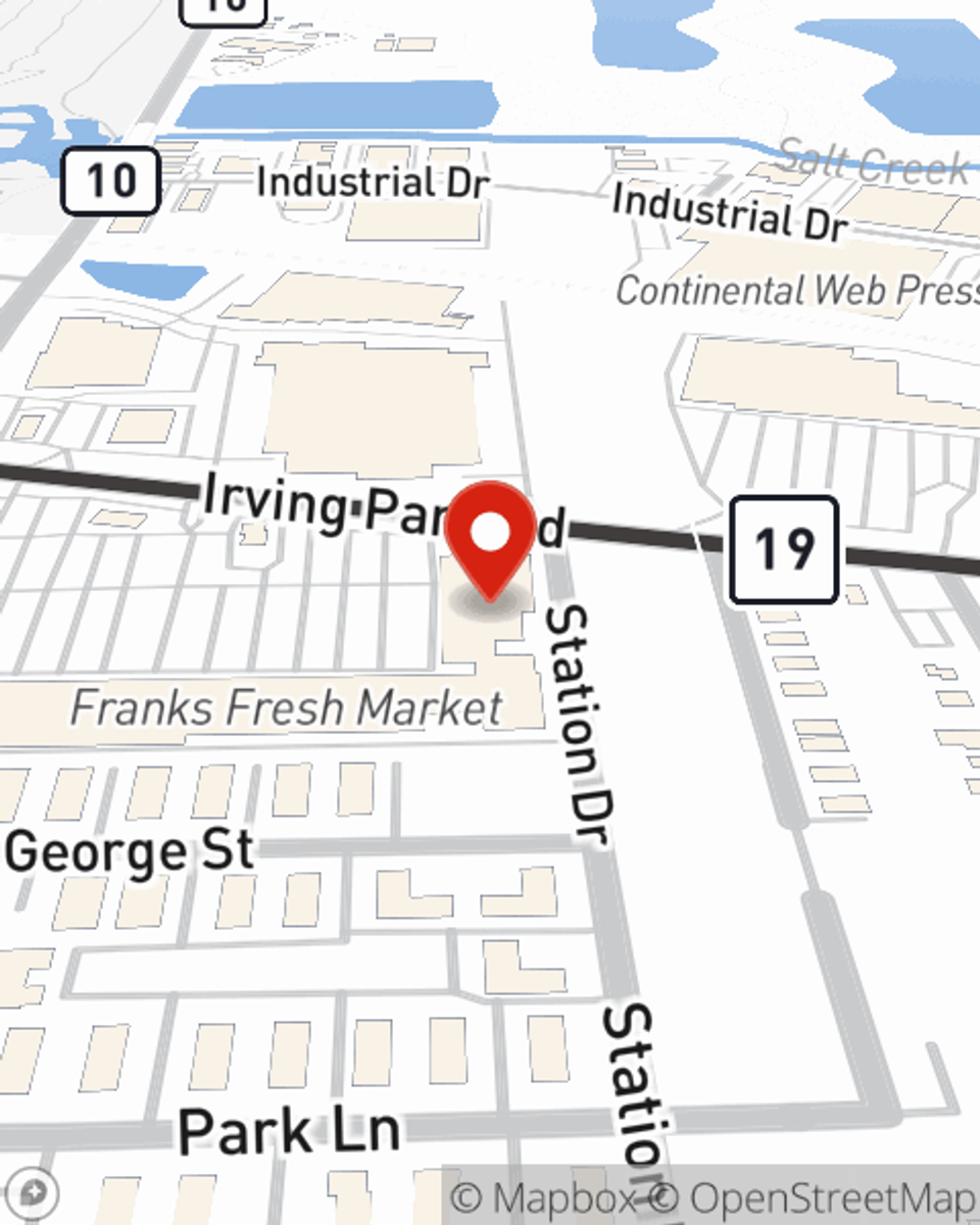

Fernando Flores

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.